– Tapas Ranjan Saha

The run away inflation is squeezing the meagre and already falling income of a vast majority. Inflation is one of those typical phenomena of capitalist economies whose openly anti-poor distributive consequences are difficult of hide. With several state assemblies already on their way to elections, the managers in UPA, finding it impossible to aviod the ire of the “aam aadmi” are airing programmed “concerns” for the “masses” while continuing with their fundamentally inflation-fuelling policoes to shift the resources for the “classes”.

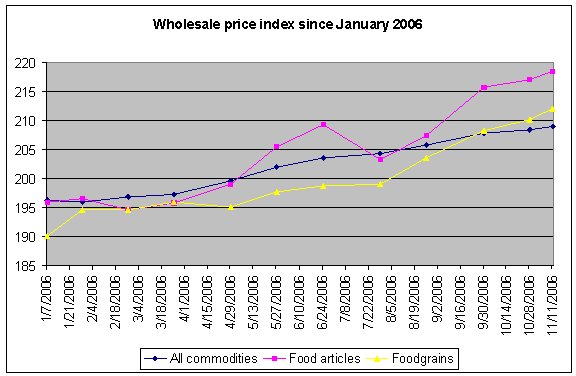

Trends of price rise are very clear. Consumer prices have been steadily increasing since last two years touching a high of 6 to 7 percent at present. Inflation had remained below six per cent in the last two years. It hoverred in the range of 5.0-5.5 per cent (the tolerance band projected by the RBI for 2006-07) during August-December 2006. it was only in the beginning of January 2007 that inflation crossed the six per cent mark.

Movements in the wholesale index show that the rise has been sharpest in food articles including food grains, pulses, etc. inflation in non-food articles went up mainly on account of the increase in prices of oilseeds. Inflation in manufactured goods also inched up further to 6.37 per cent from 6.21 per cent in the week that ended 27 January 2007. This increase was driven by a rise in prices of food products, basic metals and transport equipments. Inflation in rubber & plastic products, non-metallic minerals and machinery & machine tools, on the other hand, came down a bit in the early Feb 07.

What has been the diagnosis of the causes and prescriptions for control by the UPA mandarins? According to Chidambaram, the inflationary pressure mounting since last year has been because of (a) hardening of world commodity prices of such items as oil and the fuels, minerals and metals (b) demand-pull factors propelled by growth and consequent pressure on supplies and (c) supply shocks in specific sectors of the economy particularly primary products and food articles. The reality, however, does not substantiate Chidambaram’s first two causes as (a) domestic prices continue to rise much after international prices had levelled out; and (b) much bigger and import dependant economies like China with still higher growth rates of around 10%, continue to ensure moderate annual inflation never exceeding 1.5% to 2%. While there is substantial truth in Chidambaram’s third cause, it must be emphasised that supply shocks in specific sectors are certainly not natural but man-created and policy-induced destabilisation of the supply chain.

Thus with a set of motivated and wrong “diagnoses”, UPA’s package of “corrective prescriptions” had been one of (a) increased imports of essentials particularly wheat and other cereals (often at prices higher than those paid to domestic farmers!), (b) reduction of the import duties and of course (c) the hot favourite trick of playing around with the interest rates to curb liquidity in the economy.

Weekly WPI (Per cent change)(YoY)

6-Jan-07 13-Jan-07 21-Jan-07 27-Jan-07 3-Feb-07

All commodities (wt 100.00) 6.12 5.95 6.11 6.58 6.73

Primary articles (wt 22.03) 9.28 9.28 9.76 10.65 12.26

Food articles (wt 15.40) 9.60 8.47 9.16 9.97 12.02

Non-food articles (wt 6.14) 8.18 9.58 10.17 11.30 12.03

Minerals (wt 0.48) 10.55 20.58 18.23 18.23 18.23

Fuel, power, light & lubricants (wt 14.23) 3.63 3.70 3.67 3.67 2.33

Coal mining (wt 1.75) 0.00 0.00 0.00 0.00 0.00

Mineral oils (wt 6.99) 3.44 3.55 3.55 3.55 2.59

Electricity (wt 5.48) 4.93 4.93 4.93 4.93 2.52

Manufactured products (wt 63.75) 5.91 5.59 5.65 6.21 6.37

Food products (wt 11.54) 3.71 2.74 3.07 3.49 4.22

Beverages, tobacco & tobacco products (wt 1.34) 6.02 7.45 7.36 7.79 7.70

Textiles (wt 9.80) 2.54 2.38 2.54 2.54 2.85

Wood & wood products (wt 0.17) -3.08 -3.08 -3.08 -3.08 3.46

Paper & paper products (wt 2.04) 8.47 7.47 7.69 7.58 -3.39

Leather & leather products (wt 1.02) -5.23 -5.23 -5.23 -5.23 -1.55

Rubber & plastic products (wt 2.39) 7.51 7.51 7.51 7.29 6.85

Chemicals & chemical products (wt 11.93) 2.43 2.80 2.86 2.75 2.70

Non-metallic mineral products (wt 2.52) 13.44 12.46 12.46 12.31 11.73

Basic metals, alloys & metal products (wt 8.34) 14.08 13.36 13.40 16.31 16.71

Machinery & machine tools (wt 8.36) 8.08 7.62 7.91 7.84 7.23

Transport equipment & parts (wt 4.29) 1.43 1.55 1.31 1.31 1.37

But in the current conjuncture of the Indian economy, all the above policy moves, adopted ostensibly in the name of “curbing inflation” had the actual intention of further helping the propertied, capitalist and big trading players, who are anyway the natural “beneficiaries” of rising prices at the expense of the poor and the fixed income earners. The evident consequences of the key “anti-inflationary” moves bear out the point. After all, why didn’t the “shortage-inducted” duty free imports of wheat mitigate the price rise? The answer is the fact that the supply shortage was not natural but the direct consequences of covert protection to hoarders and speculators that all governments routinely give as also the overt policies of future trading in agricultural commodities. Thus mere increase of “quantum” of of supply does not automatically translate into “availability” of the same in the open market and fall in prices. In a system marked by steady weakening of the Public Distribution System and increasing domination of traders and hoarders armed with legal devices, it merely increased the profit potential and profit margin of the latter.

In a similar fashion, the fiscal measure of lowering of import duties for a range of industrial commodities is merely aimed at helping the traders and hoarders with no impact on the final price facing the consumer. Ostensibly rationalised in the name of lowering market prices and curbing inflation, such “liberalising” fiscal measures produce the threefold effect of (a) government revenue loss, fuelling “fiscal deficit” and hence creating inflationary potentials (b) benefiting traders with a higher profit margin with no commensurate translation into price fall and (c) creating potentials for domestic “deindustrialisation” and deflation, promoting further unemployment and wage squeeze.

Again, as the financial sectors get more and more opened up, even the much vaunted “monetary measures” are found to pay weaker results. As big corporates find access to alternate funds from foreign sources, RBI’s credit curb measures fail to produce contractionary effects. The retail, real estate and banking sectors, which are likely to get huge black money reservoir which had been their traditional financier. In either case monetary measures often fail to check the liquidity build up.

Also the excess build up of foreign exchange reserves has started precipitating its own perils as it requires continuous sterilisation by RBI for exchange rate stability, leading to increase of rupee circulation in the domestic economy and consequent inflationary build up.

Also the excess build up of foreign exchange reserves has started precipitating its own perils as it requires continuous sterilisation by RBI for exchange rate stability, leading to increase of rupee circulation in the domestic economy and consequent inflationary build up.

In sum, inflation control is not merely a matter of “mixing and matching” “fiscal-monetary-exchange rate instruments” as is made out to be the case in text books.

Its efficacy would clearly depend on the choice of the class of people to which the policy managers are committed to cater. Neo-liberal compulsions to the UPA regime and its commitment to serve the interest of the big corporates, traders and hoarders and capital market speculators, are forcing it to adopt policies which are structurally geared to fuel, rather than tame, inflationary potentials. Inflation control, therefore, can only be effective if it is targeted from the side of those who are made to bear its major brunt, namely the peasantry, agrarian labour, unorganised workers, and even the organised salaried class. This would require the govt. to remove supply bottlenecks created by the speculative activities of the hoarders, expand PDS, ensure minimum support price for farmers, ensure investment (and not imports) to boost agricultural output, expand public health care, discourage privatisation of basic public utility services like health, education, roads and water, along with a combination of “fiscal and monetary” instruments to curb capital gains and speculative spirals, speculation in real estates and maintaining of optimum foreign exchange balance.

However, with UPA’s political choice being elsewhere, inflation control is bound to remain a distant dream, while impoverishment of the poor, and a steady real wage-squeeze of fixed earners, will continue to be the order of the day.

Liberation Archive

Charu Bhawan, U-90, Shakarpur, Delhi 110092

Phone: +91-11-42785864 | Fax:+91-11-42785864 | +91 9717274961

E-mail: info@cpiml.org